Modernise your valuation assessments with e‑government GIS tools

The Local Government Property Valuation Assessment Package is a set of spatial technology tools that helps assessors to automate and optimise traditional land valuation workflows.

The package enables seamless field data collection and sharing; makes it simpler to detect errors, anomalies and gaps in data; provides a real-time snapshot of inspection works and workforce updates; improves visibility of current tax collection information; and helps engage and inform taxpayers and other business partners on assessment data.

Keen to learn more? Contact our team of technology specialists to discover how to get started.

The Local Government Property Valuation Assessment Package includes these tools:

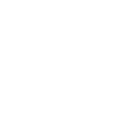

Field Force Manager

Improve coordination and the operational efficiency of workforce activities by empowering field officers with the capability to easily optimise resources, assign tasks, and manage productivity for in-field inspections.

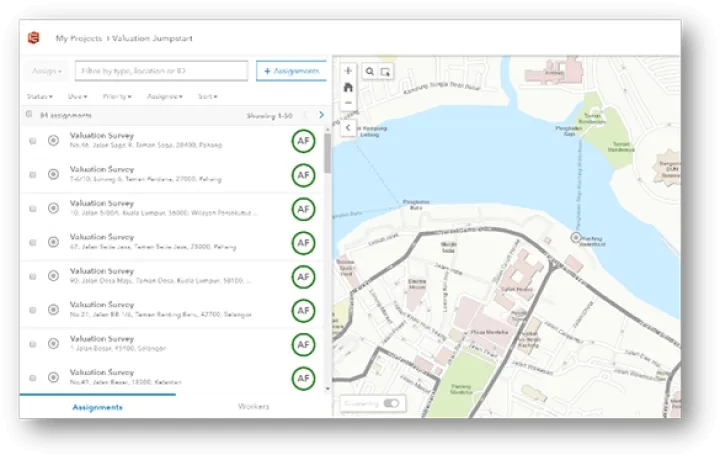

Field Inspection

Eliminate paper-based inspection methods in the field by utilising mobile devices. Data can be synced to a centralised location ensuring access anywhere, anytime, on any device. This application is integrated with Spike ikeGPS devices to ensure seamless and convenient measurement inspection – without the need for traditional measuring tapes.

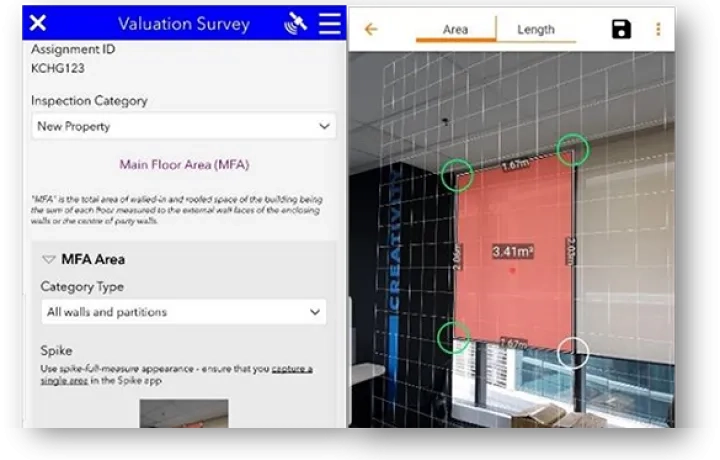

Quality Control

Identify trends and patterns such as detecting outliers and anomalies, and vertical/horizontal equities.

Valuation Modelling

Use advanced spatial analytics to build a complete valuation analysis model with outputs such as rateable value and annual value.

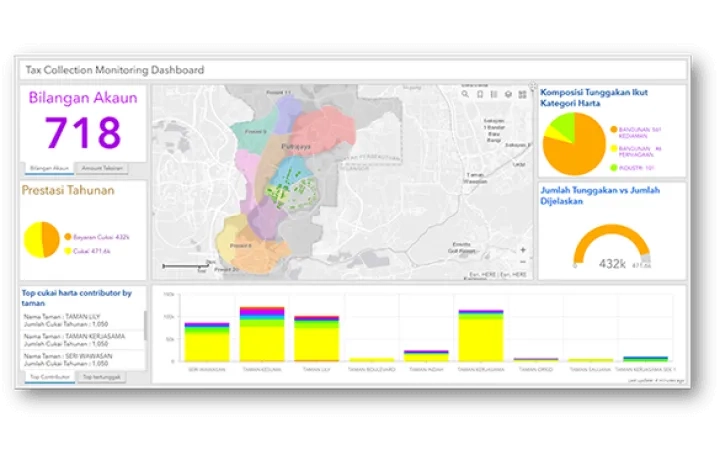

Collection Monitoring

An all-in-one screen status report that provides users with updated information on tax collection. The application can be easily accessed on any device to support more efficient tax collection monitoring.

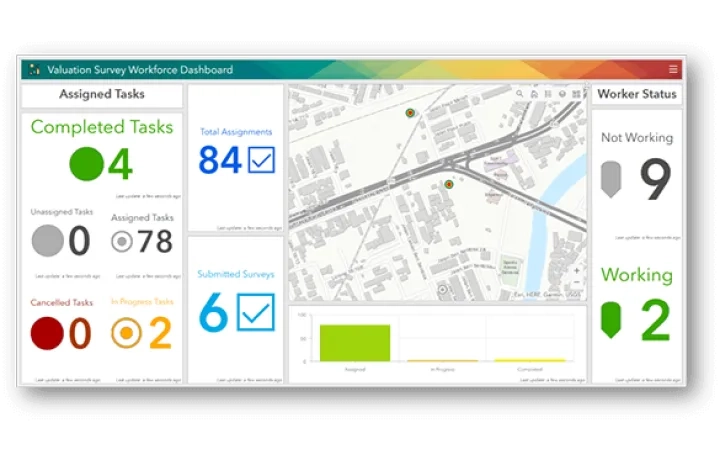

Valuation Survey Workforce Dashboard

Access real-time monitoring via an all-in-one dashboard to quickly view the progress of inspection works and workforce updates.

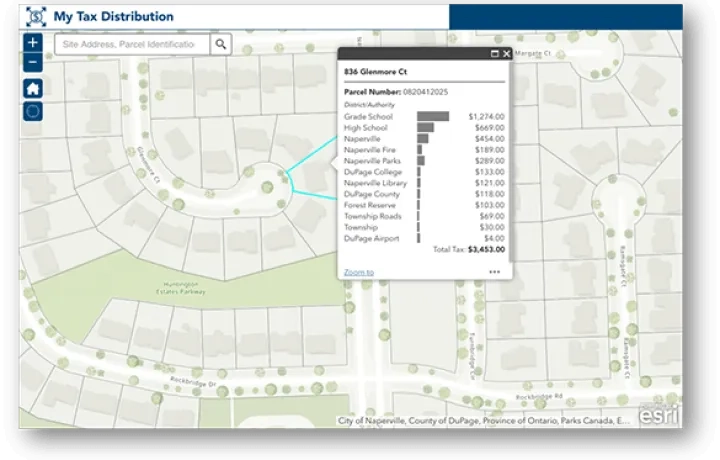

Public Data Access

Facilitate citizen engagement and public transparency to gain taxpayer’s trust by displaying relevant information on tax distribution and valuation process through intuitive self-service tools.